Quarter of a century in the insurance market – extensive experience and proven solutions.

Our standards are to respond to client requests instantly, without any waiting or delays.

We are streamlining our processes to protect your interests!

Companies that trust us and have been working with us for many years

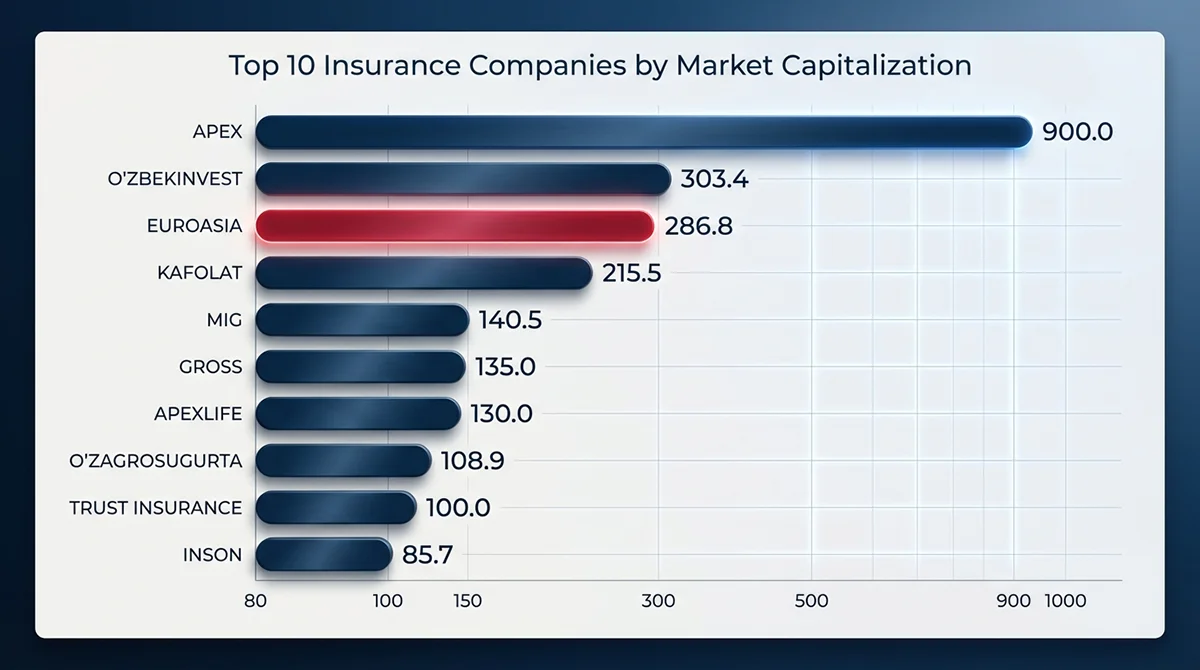

EUROASIA INSURANCE became Uzbekistan's 3rd largest insurer by capitalization, driving growth to $43M with digital transformation and market expansion.

The EUROASIA INSURANCE Startup Center program for training and developing young professionals in Uzbekistan's insurance industry.

The eighth and final weekly winner announced! Rahmonov Munirbek won a dash camera and EuroKASKO TOP package.

EUROASIA INSURANCE delegation joins PVI Insurance's 30th anniversary celebration in Hanoi. Discover how Vietnam's leading insurer achieved $1B revenue milestone and international recognition through digital transformation.

Leave your Telegram name and find out how to save up to 10,000,000 UZS on an insurance case

To get a policy, select the desired insurance type on the website, fill out the application and pay. The ready policy will be sent to your email.

The insurance contract can be concluded for up to one year or for one year.

You can renew your policy through your personal account or by applying again on the website. Be sure to provide up-to-date information and choose the required renewal term.

Contact our support service immediately by phone 1147 or via the online chat. We will guide you step by step and provide the list of required documents.

You can check the application status in your personal account or contact us by phone/feedback form. We will promptly provide information.

You need to prepare a claim application for the insured event, a copy of your passport, documents confirming the incident (for example, a report from the traffic police or a Ministry of Emergency certificate), as well as the original insurance policy

Send us your question, and we will answer you as soon as possible