Eighth Winner: Final Weekly Draw of EUROASIA Insurance Winter Giveaway

The eighth and final weekly winner announced! Rahmonov Munirbek won a dash camera and EuroKASKO TOP package.

If you own a car, you’ve probably heard of OSAGO. It’s a mandatory insurance policy that you need to drive legally—whether you're cruising through the city or heading out on a road trip. And if you’re just about to buy a car, now’s the perfect time to understand how it works.

Imagine getting into an accident—maybe you accidentally hit another car or someone gets injured. In these cases, the insurance company covers the expenses for repairs or medical treatment, as long as you have a valid OSAGO policy in Uzbekistan. It protects other drivers, their property, and their health from damage you may cause.

Your own vehicle isn’t covered under OSAGO—you’ll have to pay for those repairs yourself. If you’re looking for full protection, you can always get an additional comprehensive policy (KASKO).

The cost depends on several factors: where you live, what kind of car you drive, and how you use it. Prices typically range from UZS 20,000 to 160,000 per year. If you drive a personal vehicle for everyday use, it usually falls on the more affordable end.

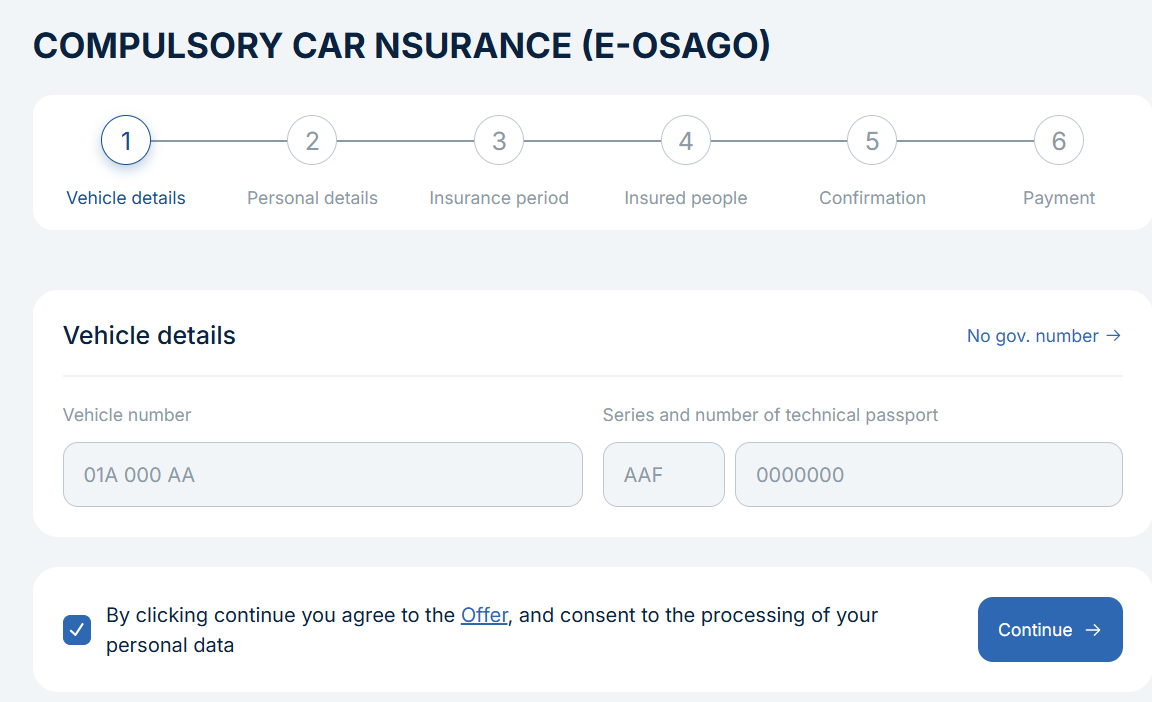

No need to visit an office, wait in line, or deal with piles of paperwork. You can now get your policy completely online—quickly, legally, and stress-free.

For example, you can apply directly through the EUROASIA Insurance website. Just enter your personal and vehicle information—and that’s it. Your electronic policy will be sent to your email and is accepted during vehicle inspections and roadside checks.

Before getting your OSAGO policy, make sure you understand exactly what is covered, any limitations, and the maximum payout in case of an accident. These details can save you from unexpected expenses and unnecessary misunderstandings later on.

OSAGO acts as your safety net when the unexpected happens on the road. Spending a few minutes to get insured now is a lot better than spending months dealing with disputes and compensation later.

The eighth and final weekly winner announced! Rahmonov Munirbek won a dash camera and EuroKASKO TOP package.

EUROASIA INSURANCE delegation joins PVI Insurance's 30th anniversary celebration in Hanoi. Discover how Vietnam's leading insurer achieved $1B revenue milestone and international recognition through digital transformation.

Seventh winner announced on January 19! Combined set: car vacuum + heated seat cover and 2 EuroKASKO modules. Join the Winter Giveaway now!

Discover how to turn your blog into an income source with EUROASIA Insurance affiliate program. Earn up to 20% from each OSAGO, KASKO, and travel insurance sale with no investment or special knowledge required.