EUROASIA INSURANCE: Training and Development of Young Professionals

The EUROASIA INSURANCE Startup Center program for training and developing young professionals in Uzbekistan's insurance industry.

Finding a reliable insurance company in Uzbekistan can be a challenge. Advertising is everywhere, and everyone promises the best service — but when it comes to real support, the experience may fall short. To avoid disappointment, use this simple but effective checklist.

The first step is to check whether the company has a valid license. This proves they operate legally and are regulated. You can verify the license online through the national regulatory authority’s website.

Customer feedback gives valuable insight into how the company handles insurance claims. Pay attention to complaints like delayed payouts, ignored inquiries, or confusing terms — all red flags to consider.

A trustworthy insurer is transparent. Ask to see a sample contract and read it carefully: look for limits, timelines, and exclusions. A good insurance company in Uzbekistan will explain everything clearly and honestly.

Call the hotline or message them on social media. If they respond promptly, politely, and with clear answers — it’s a good sign. Rude or vague responses might indicate future issues with service quality.

Modern companies offer online insurance options — no queues, no paperwork. Check whether you can receive your policy via email or messenger for added convenience.

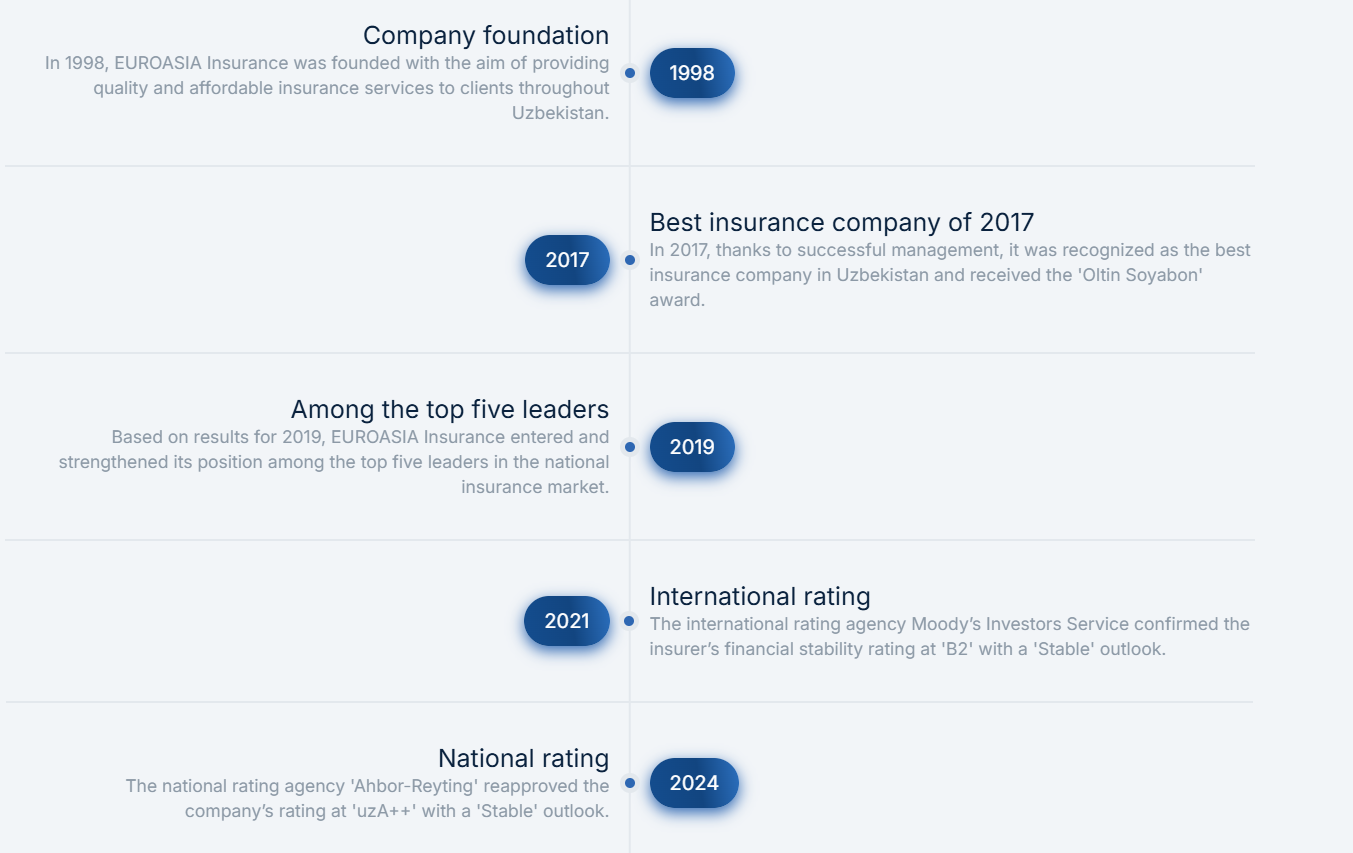

EUROASIA Insurance is one of the leading insurance providers in Uzbekistan, with over 25 years of experience. We offer 17 types of insurance services — both mandatory and voluntary. More than 1,000,000 clients have trusted us with their coverage.

We rank among the top five insurers in the country and have received multiple awards and international ratings. We pay claims on time and provide personal support to every client.

EUROASIA Insurance stands for reliability, experience, and true protection — no empty promises.

Explore our insurance products here.

The EUROASIA INSURANCE Startup Center program for training and developing young professionals in Uzbekistan's insurance industry.

The eighth and final weekly winner announced! Rahmonov Munirbek won a dash camera and EuroKASKO TOP package.

EUROASIA INSURANCE delegation joins PVI Insurance's 30th anniversary celebration in Hanoi. Discover how Vietnam's leading insurer achieved $1B revenue milestone and international recognition through digital transformation.

Seventh winner announced on January 19! Combined set: car vacuum + heated seat cover and 2 EuroKASKO modules. Join the Winter Giveaway now!