EUROASIA Insurance: Schengen Visa 2025 Requirements

Applying for a Schengen visa? Uzbek citizens need EU-standard health insurance. EUROASIA Insurance meets consular rules and protects you throughout Europe.

Your reliable policy for a carefree trip around Uzbekistan. We cover medical expenses and provide 24/7 support.

Policy in 5 minutes online

Policy is valid throughout Uzbekistan

Up to €90,000 coverage

Round-the-clock support

Enjoy peace of mind and financial protection during your holiday in Uzbekistan. The insurance covers medical expenses, emergency assistance and other unexpected situations that may occur during your trip.

Travel insurance for trips across Uzbekistan protects you from:

Medical services abroad are expensive. Even a simple doctor’s consultation can cost hundreds of dollars, and serious treatment can reach tens of thousands. A travel insurance policy allows you to get the necessary medical care without spending your own money.

Eliminates the need to pay for expensive treatment out of your own pocket. The insurance company covers all medical expenses.

The assistance service will refer you to a trusted clinic with Russian-speaking staff or an interpreter.

You travel with confidence, knowing that in any situation you will receive qualified assistance.

Understanding how travel insurance works will help you use your policy effectively during your trip. The process is simple and straightforward:

You choose an insurance program, specify your travel dates and pay for the policy online. The policy appears in the app within a few minutes.

Insurance coverage starts from the date specified as the beginning of the trip. It is important to purchase the policy before leaving the country.

If you have a health problem, you call the assistance service using the phone number in your policy. The service is available 24/7.

The operator arranges medical assistance: directs you to a clinic, calls a doctor or an ambulance.

The insurance company pays the medical expenses directly to the clinic. You do not need to spend your own money.

After the treatment is completed, you continue your trip or return home. The policy is valid until the end date.

A policy from EUROASIA Insurance is a reliable way to protect yourself from unexpected medical expenses while traveling in Uzbekistan. Uzbekistan is one of the most attractive tourist destinations, drawing visitors with its historical landmarks and hospitality.

Our insurance policy is valid throughout Uzbekistan and covers all major medical risks, including emergency medical assistance, hospitalization, dentistry and repatriation. Special attention is given to COVID-19 coverage — we understand how important this protection is while traveling.

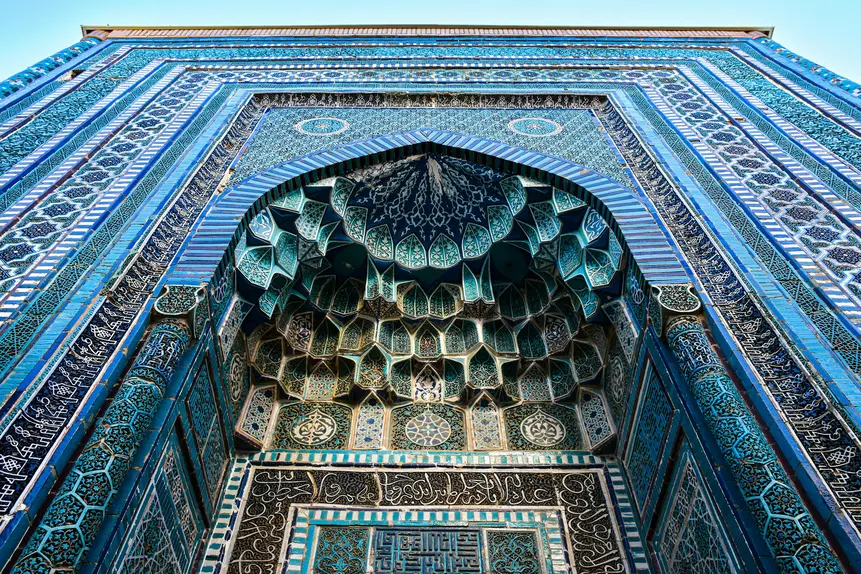

With a EUROASIA Insurance policy you can travel around Uzbekistan with peace of mind — stroll through the old town of Samarkand, discover the atmospheric streets of Bukhara, admire the architecture of Khiva or relax in the mountains of Chimgan and by the Charvak Reservoir, knowing that in case of an unexpected situation you will receive qualified medical assistance and all expenses will be covered by the insurance company.

Follow this simple step-by-step guide to receive fast and high-quality assistance.

Contact our 24/7 assistance service using the phone number indicated in your insurance policy. The line operates around the clock, without weekends or holidays.

Tell the operator your policy number, full name and describe the situation in detail. Specify your current location and contact phone number.

The operator will arrange medical assistance for you, direct you to the nearest clinic or call a doctor. Follow all instructions from the specialist. All expenses are paid directly by the insurance company.

Ideas for trips across the country: one-day journeys, weekend getaways or short holidays. Choose your destination – and don’t forget about insurance, especially if you’re planning active leisure.

Registan, Gur-Emir, Shah-i-Zinda – true must-see landmarks. The best time for walks and photos is early morning or the “golden hour” in the evening. If you’re taking the high-speed train, it’s more convenient to buy tickets in advance.

Lyabi-Hauz, the old town, madrasahs and a legendary atmosphere. The best experience is an evening stroll through the illuminated streets. For bazaars and small purchases, it’s often more convenient to have cash.

Itchan-Kala is a fortress-city where you just want to walk and take it all in. Best plan: sights during the day, and sunset from the city walls in the evening. In summer, don’t forget water and a hat.

Perfect for a weekend: fresh air, views, walks and cafés by the water. In the mountains the weather changes quickly – even in summer a light windbreaker can be useful. For trekking or extreme activities, choose insurance with an “active leisure/sports” option.

Margilan and its crafts, Rishtan and ceramics, cosy towns and local cuisine. Great for those who love authenticity and unhurried travel. It’s better to plan the route in advance so you can visit several points in one trip.

For those who want something “off the beaten path”: museums, unique culture and unusual locations of the region. Distances can be long, so plan transport, water and basic essentials for the road in advance.

Plan by season: in summer it’s hot (SPF and water are a must), in winter it’s about the mountains (warm layers and non-slip footwear).

Download offline maps and save your accommodation address — mobile coverage can be unstable on the road and in the mountains.

In tourist areas cards are accepted more often, but at bazaars and small local places cash is still more convenient.

If you plan trekking, cable cars or extreme activities, choose a policy with an “active leisure/sport” option.

Keep documents and money in different places, and store a photo of your passport/ID on your phone (and ideally in the cloud as well).

For long journeys, take water, snacks and a mini first-aid kit (plaster, antiseptic, pain relief).

If you’re travelling with family, think through a “Plan B” in advance: nearest pharmacy/clinic and assistance contacts from your policy.

Applying for a Schengen visa? Uzbek citizens need EU-standard health insurance. EUROASIA Insurance meets consular rules and protects you throughout Europe.

Travel insurance isn’t a luxury for Uzbekistan travelers—it’s essential. Get medical coverage, visa-ready documents and 24/7 support from Tashkent.

Many people believe that reliable insurance always comes with a high price tag. However, in reality, quality protection can be affordable.

Feeling invincible when you’re young is natural, but illness and accidents can strike. Health insurance in Uzbekistan gives a vital safety net and support.

For domestic trips within Uzbekistan, travel insurance is usually not a mandatory requirement. However, we strongly recommend purchasing a policy to get financial protection in case of illness, injury, emergency assistance, hospitalization, and other unexpected expenses during your trip.

Yes. The policy is designed for trips within the territory of Uzbekistan and covers insured events that occur while travelling inside the country (depending on the program conditions and selected options).

Immediately contact the 24/7 assistance service at the phone number indicated in your policy. The operator will advise you on the next steps and, if necessary, direct you to an appropriate medical facility. In an emergency (life-threatening situation), call an ambulance first and then inform the assistance service as soon as possible.

If you visit a medical facility recommended and coordinated by the assistance service, expenses are usually paid directly by the insurer (according to the rules of the specific program). If you go to a clinic on your own, you may need to pay on the spot and then submit documents for reimbursement. Whenever possible, contact the assistance service first (except in emergencies).

Yes, in many cases you can still purchase a policy after the trip has started. However, you must consider the waiting period: coverage does not begin immediately (often only after 24–48 hours). Events that occurred before the start date of the policy are not covered.

For trips within Uzbekistan, an average coverage amount is usually sufficient to pay for outpatient treatment, diagnostics, and, if needed, hospitalization. If you plan active leisure (mountains, trekking, skiing), travel to remote regions, or simply want maximum confidence, choose extended coverage.

The basic policy covers standard tourist activities. For higher-risk activities (mountain routes, skiing, active sports, etc.) it is recommended to purchase a policy with the “SPORT/ACTIVE LEISURE” option. This option increases the policy cost but extends coverage for such cases.

Yes, in most programs treatment of viral diseases, including COVID-19, is covered (diagnostics, treatment, hospitalization if necessary) within the policy conditions. Exact limits and exclusions depend on the selected program.

The electronic policy has full legal force — you can show it from your phone. In practice, however, it is convenient to have a copy: save the policy on your phone, in your email and in the cloud, and if possible print out one page (or the entire document) so you are not dependent on internet access or battery level.

Send us your question and we will get back to you as soon as possible.