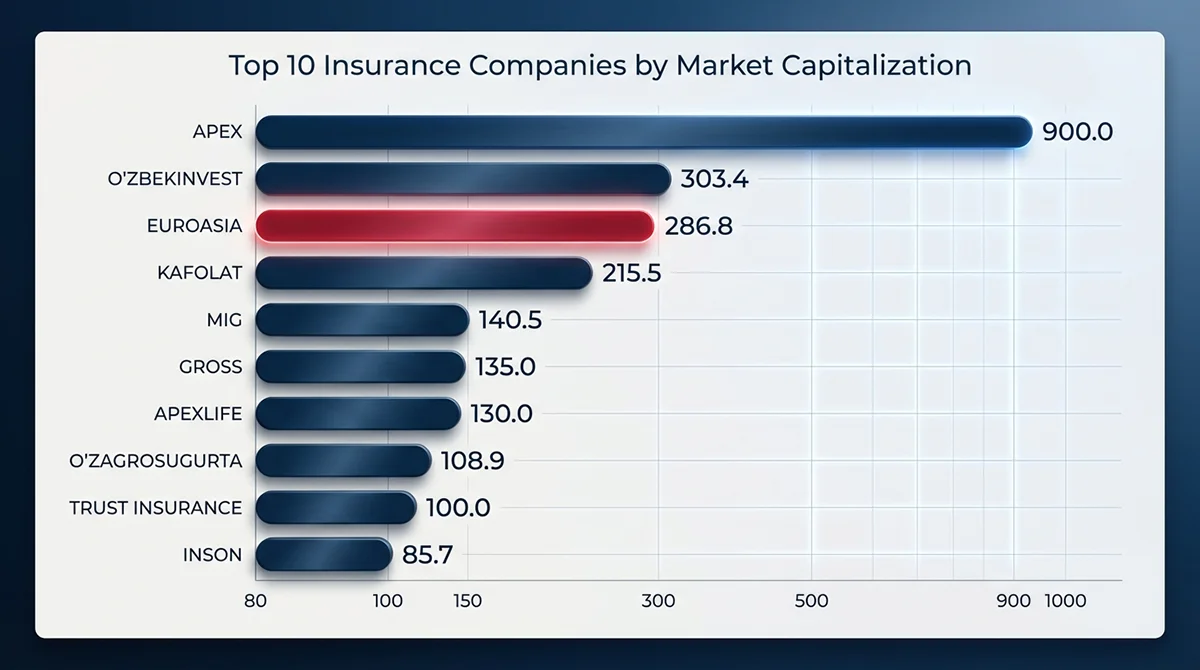

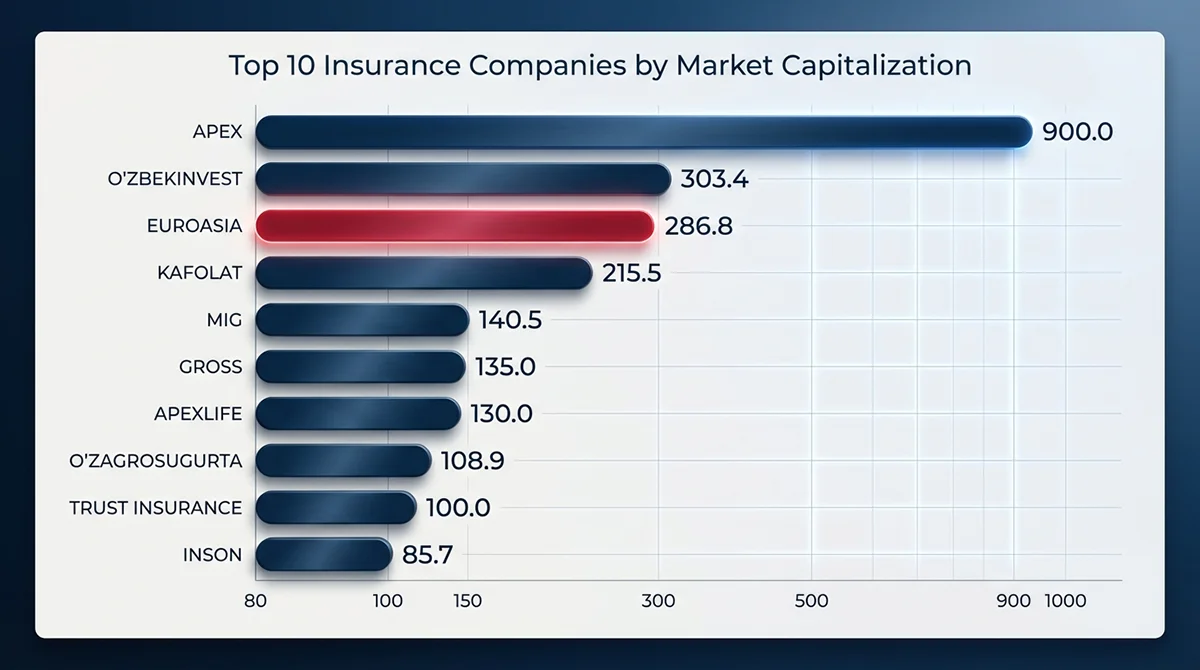

EUROASIA INSURANCE Rises to Top 3 in Uzbekistan with $43M Growth Plan

EUROASIA INSURANCE became Uzbekistan's 3rd largest insurer by capitalization, driving growth to $43M with digital transformation and market expansion.

We're concluding our series of articles about the benefits of KASKO in Uzbekistan. We've already discussed comprehensive protection, quick payouts, additional services, and the special importance of the policy for beginners and luxury car owners. Today we'll tell you about the fifth reason to choose KASKO – the amazing simplicity and convenience of arranging it online.

In the past, insurance arrangement was often associated with trips to company offices, long waits in queues, and filling out numerous paper forms. Fortunately, the digitalization of Uzbekistan's insurance market has changed this situation. Today you can arrange KASKO online in literally 10-15 minutes without leaving your home or office.

The process is maximally simplified and intuitively clear:

Visit the insurance company's website: For example, the EUROASIA INSURANCE website.

Find the online KASKO calculator: Usually located in the auto insurance section.

Enter vehicle data: Make, model, year of manufacture, value, engine volume, etc.

Enter driver data: Age, driving experience.

Choose an insurance package: Companies offer different options – from basic to premium (for example, LITE, SMART, DELUXE at EUROASIA INSURANCE).

Get a cost calculation: The calculator instantly shows how much KASKO costs for your case.

Fill out the application: Provide your contact information.

Pay for the policy online: Using a bank card or other electronic payment systems.

Receive the electronic policy: The ready policy will be sent to your email and will be available in your personal account on the website.

Time savings: No trips or queues.

Convenience: You can arrange a policy at any time of day from anywhere with internet access.

Transparency: You see how the price is formed and can compare different options.

Speed: The entire process takes just minutes.

Reliability: An electronic policy has the same legal force as a paper one, but it's impossible to lose.

Online calculators allow you not only to find out the price but also to select the optimal insurance package. You can compare the cost and contents of different packages (for example, LITE, SMART, DELUXE), add or remove additional options, and see how this affects the final price. KASKO calculation becomes completely transparent.

The ability to easily and quickly arrange KASKO online makes this type of insurance even more attractive and accessible to all car owners in Uzbekistan. Modern technology allows you to get reliable protection for your car without unnecessary hassles.

With this, we conclude our series of articles about KASKO. We hope it helped you better understand the advantages of this type of insurance. If you have any remaining questions, you can always contact EUROASIA INSURANCE specialists.

Protect your car – calculate the cost of KASKO online right now!

EUROASIA INSURANCE became Uzbekistan's 3rd largest insurer by capitalization, driving growth to $43M with digital transformation and market expansion.

The EUROASIA INSURANCE Startup Center program for training and developing young professionals in Uzbekistan's insurance industry.

The eighth and final weekly winner announced! Rahmonov Munirbek won a dash camera and EuroKASKO TOP package.

EUROASIA INSURANCE delegation joins PVI Insurance's 30th anniversary celebration in Hanoi. Discover how Vietnam's leading insurer achieved $1B revenue milestone and international recognition through digital transformation.