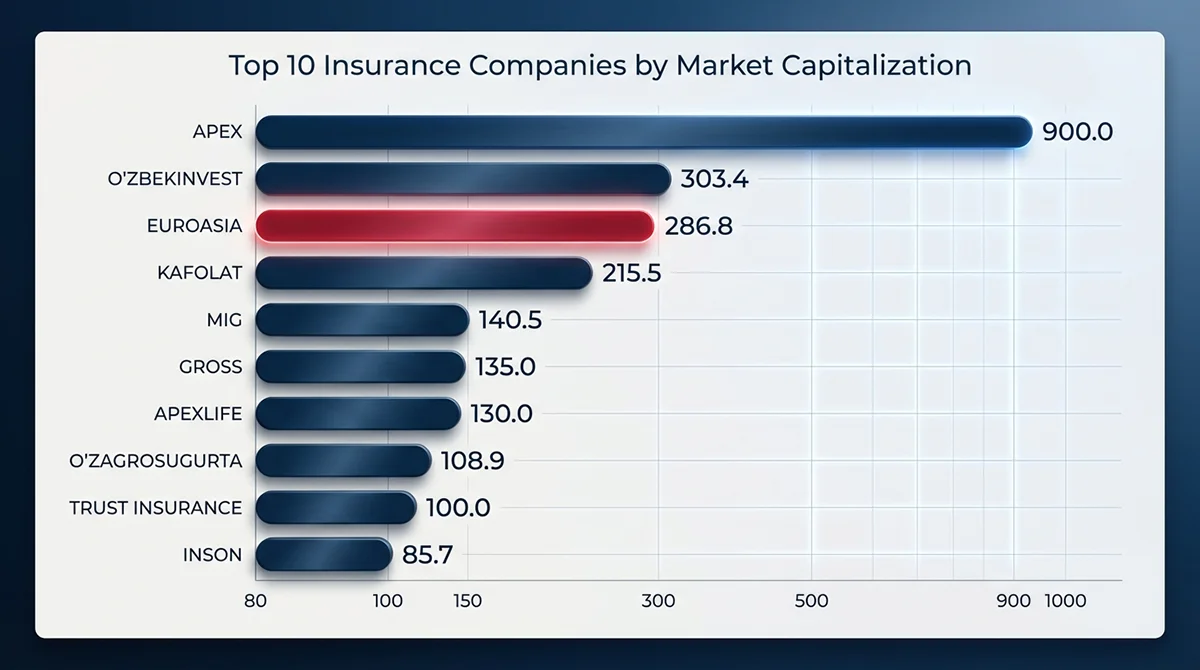

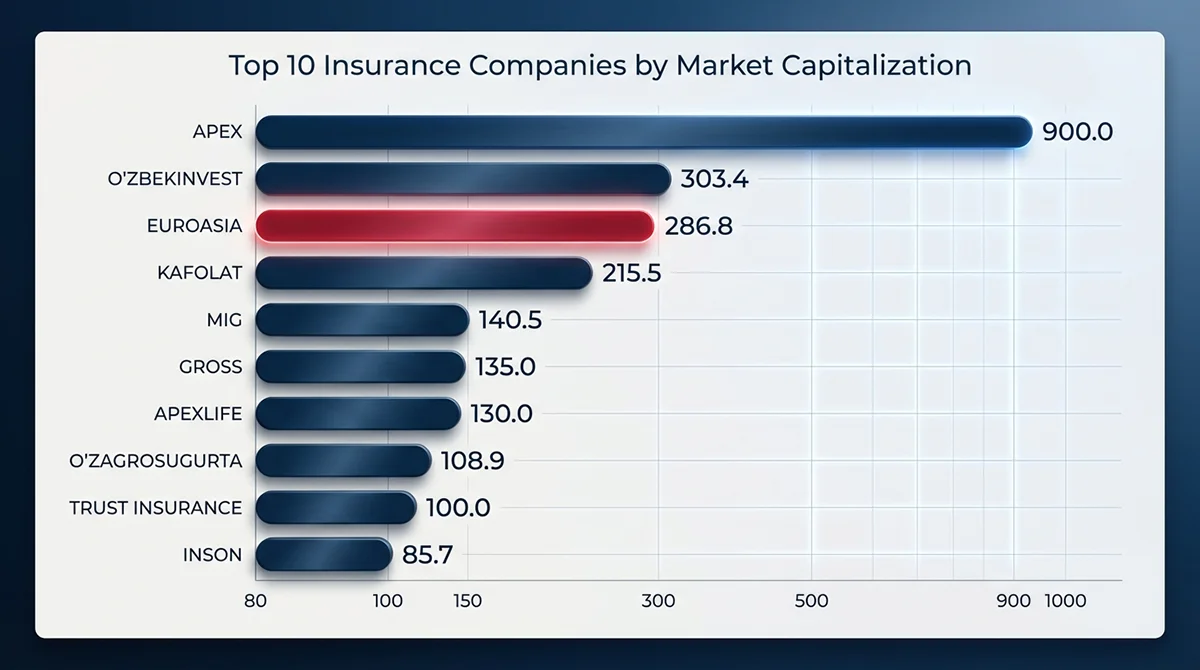

EUROASIA INSURANCE Rises to Top 3 in Uzbekistan with $43M Growth Plan

EUROASIA INSURANCE became Uzbekistan's 3rd largest insurer by capitalization, driving growth to $43M with digital transformation and market expansion.

Compulsory Motor Third Party Liability Insurance, known as OSAGO (also referred to as OSGOVTS in Uzbekistan), is an essential part of every car owner’s life. However, there are numerous myths and misconceptions surrounding this type of insurance, which distort public perception and can lead to serious consequences. This is especially relevant for new drivers who are planning to buy a car or have recently started driving.

Let’s look at the 5 most common myths about OSAGO in Uzbekistan.

This is probably the most persistent stereotype. Many car owners fear that in the event of an accident, they’ll have to endlessly visit the insurance office, gather piles of paperwork, and still either receive nothing or get an unreasonably low compensation.

In reality: The OSAGO payout process is strictly regulated by Uzbek law. Reliable, licensed insurers with a good reputation (check car insurance ratings) make payments within the legally established timeframe (usually up to 30 days), provided that the accident is properly documented and all required paperwork is submitted. Delays are typically caused by objective reasons, such as incomplete documentation, the need for additional expert analysis, or waiting for a court decision in disputed cases. Additionally, Uzbekistan has a Guarantee Fund that ensures compensation if the liable party’s insurer goes bankrupt or the at-fault driver is uninsured or unidentified. OSAGO is a functioning and effective system.

Some drivers view OSAGO merely as a government formality, useful only to avoid fines. They believe the chances of an accident are low and that the money would be better spent elsewhere.

In reality: An OSAGO policy is your financial protection. Imagine you cause an accident. Even a minor collision can lead to repair costs worth several million soms. And if people are injured? Medical expenses can be massive. Compulsory auto insurance covers such third-party liability risks up to the legal limit (e.g., 40 million UZS). The cost of an OSAGO policy — especially if purchased online — is negligible compared to the potential financial burden. It’s not an expense — it’s an investment in peace of mind.

This misconception is common among novice drivers. They assume that any damage to their own vehicle will be covered if they have insurance.

In reality: OSAGO covers your liability — not your car. If you’re at fault in an accident, OSAGO does not pay for repairs to your vehicle. It is designed to compensate the other party’s damages. To protect your car from theft, fire, or accident damage (even if you’re at fault), you need additional voluntary insurance — KASKO. OSAGO and KASKO serve different purposes and are separate products.

| Insurance Case | Liability Insurance | Comprehensive (CASCO) |

|---|---|---|

| Damage to your car in an at-fault accident | Not covered | Covered |

| Damage to your car when other party is at fault | Covered (through at-fault party's insurance) | Covered |

| Damage to your car, at-fault party fled | Not covered | Covered |

| Vehicle theft | Not covered | Covered |

| Natural disaster damage | Not covered | Covered |

| Vandalism damage | Not covered | Covered |

It might seem logical that if OSAGO is a state-regulated mandatory insurance, the price must be fixed.

In reality: While base tariffs and pricing coefficients are set by law, insurers can apply various adjustments (for example, discounts for accident-free driving — known as the bonus-malus system) and offer different service levels or perks. Moreover, online aggregators or direct insurer websites often feature better deals or promotions. So it’s definitely worth comparing before purchasing a policy.

Some drivers, especially older ones, mistrust digital services and prefer having a physical document.

In reality: An e-OSAGO policy has the same legal standing as a paper version. It’s registered in the national database, and police can verify it by your car’s plate number or your ID. Buying OSAGO online is fast (usually under 5 minutes), secure, and convenient. The policy is sent to your email or app and can be stored on your phone or printed. The key is to use official company websites or trusted platforms, and always check authenticity through official services.

Dispelling these myths will help you feel more confident on the road and take full advantage of auto insurance services in Tashkent and across Uzbekistan. Remember: awareness is the key to your safety and financial stability.

EUROASIA INSURANCE became Uzbekistan's 3rd largest insurer by capitalization, driving growth to $43M with digital transformation and market expansion.

The EUROASIA INSURANCE Startup Center program for training and developing young professionals in Uzbekistan's insurance industry.

The eighth and final weekly winner announced! Rahmonov Munirbek won a dash camera and EuroKASKO TOP package.

EUROASIA INSURANCE delegation joins PVI Insurance's 30th anniversary celebration in Hanoi. Discover how Vietnam's leading insurer achieved $1B revenue milestone and international recognition through digital transformation.